FAQs

How do I contact the Secretariat of the Poseidon Principles Association?

Please send any questions to the Secretariat to:

info@poseidonprinciples.org

Background

What role does finance play in the maritime industry?

The maritime industry has provided efficient economic services that have played a key role in enabling the growth of global trade and global economic development. However, this has not been without some adverse consequences unique to the maritime sector. The continued success of the maritime industry is intrinsically linked to the well-being and prosperity of society. Therefore, all industry participants must play a role in addressing adverse consequences.

The Poseidon Principles were developed in recognition financial institutions’ role in promoting responsible environmental stewardship throughout the maritime value chain. They are an initiative unique to ship finance and bridge climate change commitments set out by the International Maritime Organization (IMO) as well as the expanding environmental expectations of financial institutions.

The Poseidon Principles were developed through a global consultation process. They borrow the concept of creating globally agreed common baselines that can be act as established minimum standards from the Equator Principles. By making valuable asset-level climate alignment data available to financial institutions, the Poseidon Principles are supportive of the Task Force on Climate Related Financial Disclosures (TCFD). They are also supportive of the Principles for Responsible Banking, the Carbon Disclosure Project, and the Energy Transitions Commission. TEST

What is the IMO, and what did they decide regarding GHG emissions?

The IMO (International Maritime Organisation) is the United Nations’ specialised agency with responsibility for the safety and security of shipping and the prevention of marine and atmospheric pollution by ships.

The IMO approved an initial greenhouse gas (GHG) strategy in April 2018 to reduce GHG emissions generated by shipping activity, prescribing that international shipping must reduce its total annual emissions by at least 50% of 2008 levels by 2050, whilst pursuing efforts towards phasing them out as soon as possible in this century. Following the 2018 GHG Strategy, the IMO approved a revised strategy on the reduction of GHG emissions from ships in July 2023.

This 2023 IMO GHG Strategy sets out the following levels of ambition:

- to reduce the total annual GHG emissions from international shipping by at least 20%, striving for 30%, by 2030, compared to 2008

- to reduce the total annual GHG emissions from international shipping by at least 70%, striving for 80%, by 2040, compared to 2008.

- GHG emissions from international shipping to peak as soon as possible and to reach net-zero GHG emissions by or around, i.e. close to 2050

Further terms that do not define GHG reduction rates, but are also in the revised level of ambition include:

- carbon intensity of the ship to decline through further improvement of the energy efficiency for new ships

- carbon intensity of international shipping to decline to reduce CO2 emissions per transport work, as an average across international shipping, by at least 40% by 2030, compared to 2008

- uptake of zero or near-zero GHG emission technologies to represent at least 5%, striving for 10%, of the energy used by international shipping by 2030

Moreover, any activity related to emission reduction and climate alignment in shipping will need to capture lifecycle emissions (well-to-wake approach) as well as all the relevant GHG species as specified by the IMO.

The strategy also states that a basket of antedate measure(s), delivering on the reduction targets, should be developed to promote the energy transition of shipping and provide the world fleet a needed incentive while contributing to a level playing field and a just and equitable transition.

According to the IMO’s Fourth GHG Study 2020, the sector accounted in 2018 for 2.89% of global anthropogenic emissions. Left unchecked, shipping emissions were expected to grow by 90-130% by 2050 compared to 2008 levels.

While CO₂ represented almost all of the industry’s GHG emissions (98%), methane (CH₄) emissions from ships increased over this period (particularly over 2009–2012) due to increased activity associated with the transport of gaseous cargoes by liquefied gas tankers due to methane slip. There is potential for this trend to continue in the future if shipping moves to liquefied natural gas (LNG)-powered ships.

Nations pledged in the 2015 Paris Agreement “to achieve a balance between anthropogenic emissions by sources and removals by sinks of GHG in the second half of this century” (UNFCC, 2015). This means getting to “net zero emissions” between 2050 and 2100. 2050 therefore represents a key milestone in the Paris Agreement, which the IMO explicitly references in its Strategy. The Intergovernmental Panel on Climate Change (IPCC) has quantified this target through a specific limit to a global temperature rise due to anthropogenic emissions of not more than 1.5°C compared to pre-industrial levels.

The 2023 IMO GHG Strategy does not alone secure 1.5°C future.

The Poseidon Principles

What are the Poseidon Principles?

The Poseidon Principles are a framework for assessing and disclosing the climate alignment of ship finance portfolios. The Poseidon Principles create common global baselines that are consistent with and supportive of society’s goals to better enable financial institutions to align their portfolios with responsible environmental impacts.

The four Principles are:

- Assessment

- Accountability

- Enforcement

- Transparency

What is the objective of the Poseidon Principles?

The objective is to gather a group of committed financial institutions to take ownership of a set of principles to integrate climate considerations into lending decisions in ship finance, consistent with the climate-related goals of the IMO.

The Principles aim to be voluntary, practical to implement, verifiable, fact-based, and effective. Signatories commit to implementing the Principles in their internal policies, procedures and standards.

The Principles are intended to evolve following a regular review process to ensure that the Principles are practical and effective, are linked to and supportive of the IMO’s GHG measures as they develop over time, and that further environmental factors are identified for inclusion.

What are the objectives of the four Principles?

This principle provides step-by-step guidance for measuring the climate alignment of signatories’ activities with the agreed climate target. It establishes a common methodology for calculating the emission intensity and total GHG emissions, and thus also provides the input needed to track the decarbonisation trajectories used to assess signatories’ alignment.

To ensure that information provided under the principles is practical, unbiased, and accurate, it is crucial that signatories only use reliable data types, sources, and service providers.

This principle provides the mechanism for meeting the requirement of the Poseidon Principles. It also includes a covenant clause to ensure data collection.

The intent of the transparency principle is to ensure both the awareness of the Poseidon Principles and that accurate information can be published by the Secretariat in a timely manner. Furthermore, transparency is key in driving behavioural change.

What is the scope of the Poseidon Principles, and why?

Climate alignment is currently the only environmental factor considered by the Poseidon Principles. This scope will be reviewed and may be expanded by signatories on a timeline that is at their discretion.

The Poseidon Principles are applicable to lenders, relevant lessors, and financial guarantors including export credit agencies. The Poseidon Principles must be applied by signatories in all business activities that are:

- that are credit products (including bilateral loans, syndicated loans, club deals, and guarantees) secured by vessel mortgages or finance leases secured by title over vessel or unmortgaged ECA loans tied to a vessel; and

- where a vessel or vessels fall under the purview of the International Maritime Organization (IMO) (e.g. vessels 5,000 gross tonnage and above which have an established Poseidon Principles trajectory whereby the carbon intensity can be measured with IMO Data Collection System (DCS) data).

When were the Poseidon Principles officially launched?

The Poseidon Principles were launched on 18 June 2019.

Who has been involved in developing the Poseidon Principles?

Workshops and presentations were held in 2018 across Singapore, London, NYC, and Hong Kong to elicit feedback from approximately 20 financial institutions on the development of the Poseidon Principles. The development of the Poseidon Principles was led by a drafting group spearheaded by global shipping banks – Citi, Société Générale, and DNB – in collaboration with leading industry players – A.P.Møller Mærsk, Cargill, Euronav, Gram Car Carriers, Lloyd’s Register and Watson Farley & Williams – with expert support provided by the Global Maritime Forum, Rocky Mountain Institute and University College London Energy Institute.

Were shipowners involved in the discussions of the Poseidon Principles?

Shipowners of varying sizes and geographies have been engaged and consulted throughout the process of developing the Poseidon Principles.

A first draft was presented and discussed at a session held in conjunction with the Global Maritime Forum’s Annual Summit in Hong Kong in October 2018. Participants there welcomed the Principles with great enthusiasm.

Have international groups and NGOs been involved?

The Global Maritime Forum, Rocky Mountain Institute, and UMAS have been part of this work since its inception. They have also been working with other financial initiatives – such as 2 Degrees Investing and the Climate Bonds Initiative – to ensure that various initiatives within the shipping sector are compatible.

A broader group of NGOs and other stakeholders have been kept informed throughout the process.

How are Poseidon Principles related to the Poseidon Principles for Marine Insurance and the Sea Cargo Charter?

The Poseidon Principles for Marine Insurance were developed later (December 2021) and were strongly inspired by the Poseidon Principles. The four core Principles are the same for both the Poseidon Principles and the Poseidon Principles for Marine Insurance and both initiatives also use the same metric – AER (Annual Efficiency Ratio). The Poseidon Principles for Marine Insurance, however, have also chosen to take steps toward alignment with the Paris Agreement by providing two trajectories: a 50% CO₂ reduction trajectory in alignment with the 2018 IMO GHG Strategy and a 100% CO₂ reduction trajectory. They have also committed to updating current trajectories in 2024 to align with the 2023 IMO GHG Strategy.

Another initiative similar to the Poseidon Principles is the Sea Cargo Charter – a framework for responsible chartering. The ambition to develop the Sea Cargo Charter finds its source is the very early stages of the Poseidon Principles. The four core Principles are the same for both the Poseidon Principles and the Sea Cargo Charter, but the two frameworks rely on different metrics. The Poseidon Principles uses AER and can therefore rely on the IMO DCS to collect data, while the Sea Cargo Charter uses EEOI and thus have a different approach to source data.

What are the elements that are or will be addressed in current and future reviews of the Poseidon Principles?

Signatories to the Poseidon Principles recognise that the association is intended to evolve over time and agree to contribute to a review process when they, as signatories, decide to undertake it. This process will ensure that the Poseidon Principles are practical and effective, is linked to and supports the goals set by the IMO, and that further adverse impacts are identified for inclusion.

The most recent updates are to align with the ambition in the revised IMO GHG Strategy from July 2023, the Poseidon Principles have updated its trajectories in September 2023 and will fine tune it over 2024.

The Poseidon Principles were, until 2023, aligned with the ambition set by the IMO in its initial strategy in 2018 with a decarbonisation trajectory based on a target of at least 50% reduction of GHG emissions by 2050 on 2008 levels. At MEPC 80 in July 2023, a revised GHG Strategy was adopted introducing a higher ambition as well as differences in the emission boundaries to be considered. The Poseidon Principles have implemented this revision to bring its existing methodology in line with the new ambition levels, indicative checkpoints and emission boundaries set by the IMO. This revision entails including fuels lifecycle emissions factors in the methodology to report on a well-to-wake basis.

Furthermore, the IMO MEPC timetable currently has a mandated review of the 2023 IMO GHG Strategy in 2028. In 2025, it is likely that the Fifth IMO GHG Study will be published which will give an opportunity to reevaluate the impact on the Poseidon Principles. In the nearer future, the next steps would be to assess the IMO Lifecycle Assessment (LCA) guidance which will provide industry accepted well-to-wake emission factors and CO2e factors to be published in Q2 2024.

What are the changes to the Poseidon Principles’ methodology based on the 2023 IMO GHG strategy?

The Poseidon Principles have so far been aligned with the ambition set by the IMO in its Initial Strategy in 2018 with a target of at least 50% reduction of GHG emissions by 2050 on 2008 levels. At MEPC 80 in July 2023, a revised strategy was put in place introducing higher ambition as well as differences in the emission boundaries to be considered.

There are four main elements that changed with the adoption of the new trajectory:

- Addition of minimum interim targets of 20% GHG reduction in 2030 and 70% GHG reduction in 2040 relative to 2008

- Addition of striving for interim targets of 30% GHG reduction in 2030 and 80% GHG reduction in 2040 relative to 2008 (voluntary)

- A net-zero GHG target in 2050

- GHG reduction targets are to be on a well-to-wake CO2e perspective

What are the changes to the report and data collection based on the revised trajectory?

The signatories of the Poseidon Principles decided on 27 September 2023 to align the association’s decarbonisation trajectory with the 2023 IMO GHG Strategy, reporting against the following baselines:

- For the 2023 report (on 2022 data), signatories should disclose their climate alignment scores against the previous trajectory (50% CO2 reduction by 2050 as set in the initial IMO GHG Strategy), for the purpose of tracking progress and comparing data from previous years.

- Signatories to report against the striving for target on top of the minimum trajectories of the interim checkpoints.

- The signatories will move to a more granular approach considering the full life cycle approach of emissions (move from tank-to-wake to well-to-wake) and all GHG species – using a set of default emission factors.

The data-collection process remains the same as in previous years.

Becoming a Signatory

Who can be a signatory?

At present, lenders, lessors and financial guarantors – including export credit agencies – with shipping portfolios can become signatories.

What is the process of becoming a signatory?

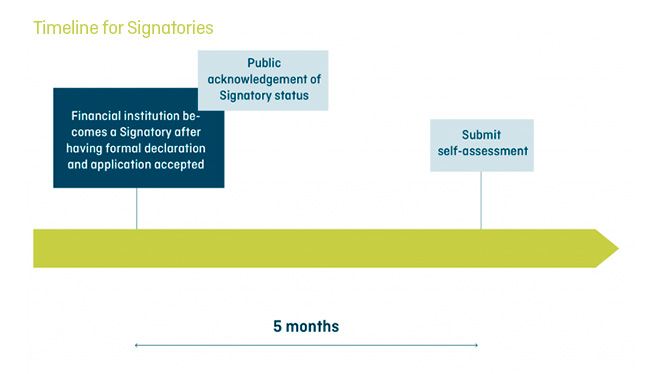

Institutions wishing to become a signatory of the Poseidon Principles must submit the Standard Declaration together with the Signatory Application and the Membership Agreement to the Secretariat of the Poseidon Principles Association. Once accepted into the Association, the signatory will have five months to complete and submit the Self-Assessment to the Secretariat. All documents are available from the Secretariat.

What is the purpose of the Standard Declaration?

The Standard Declaration is the formal commitment required of financial institutions to become a signatory. It announces the intent of the financial institution to follow all requirements of the Principles. The Standard Declaration is available from the Secretariat.

What is the purpose of the Signatory Application?

Along with the Standard Declaration, a financial institution wishing to become a signatory must complete the Signatory Application. This document outlines who is responsible for contact, reporting, invoicing, and other necessary functions to implement and maintain the Poseidon Principles within the financial institution. The Signatory Application is available from the Secretariat.

What is the purpose of the Membership Agreement?

The third document an organisation must submit in order to become a signatory is the Membership Agreement. This document outlines legal obligations for signatories. The Membership Agreement is available on the website.

What is the purpose of the Self-Assessment?

The purpose of the Self-Assessment is to ensure that each signatory has made appropriate arrangements to fulfil its obligations under the Poseidon Principles and identified any challenges to doing so. The Self-Assessment is as brief as possible to reduce the administrative burden, while still addressing the core responsibilities of signatories to the Poseidon Principles. The questions focus on ensuring that signatories are aware of timelines and obligations under the Poseidon Principles, have engaged internal stakeholders, have engaged clients, and have a plan for engaging the necessary service providers to complete their climate alignment assessment. The Self-Assessment questions are available from the Secretariat.

How does this fit with other sustainable banking or finance initiatives?

What are the fees for signatories?

The Sign-on Fee for 2025 is € 12,000 and is paid to the Poseidon Principles Association when becoming a signatory (one time fee).

The Annual Fee for 2025 is € 10,000 and is paid annually to the Poseidon Principles Association in accordance to the Governance Rules.

In the first year of membership, the Annual Fee is required in addition to the Sign-on Fee. Both fees are approved by signatories during the Annual Meeting.

What are the benefits of being a signatory?

The Poseidon Principles were developed in recognition financial institutions’ role in promoting responsible environmental stewardship throughout the maritime value chain. Signatories will be recognised for contributing to an initiative that is ground-breaking in both the spheres of shipping and sustainable finance. Furthermore, signatories will also gain access to valuable asset-level information that can be used to assess potential climate risks that may impair returns in the future.

I’m not a lender/lessor/guarantor, but I’m still a financial institution – can I become a signatory?

Currently, the Poseidon Principles are only applicable to lenders, relevant lessors, and financial guarantors including export credit agencies. Please contact the Poseidon Principles Secretariat to register your interest so that the Principles can be expanded in the future to include other institutions.

I’m not a financial institution - can I endorse the Poseidon Principles?

Currently, there is not an official way to endorse or formally support the Poseidon Principles. Please contact the Poseidon Principles Secretariat to register your interest so that you can be contacted should a pathway for endorsement become available.

I’m a third party / service provider – can I endorse the Poseidon Principles?

The “preferred pathway” information flow in the Poseidon Principles methodology recommends the use of verification mechanisms (from third parties/service providers) to maintain data veracity. While the Poseidon Principles recognize the important role that verification mechanisms play in providing unbiased information to the industry, the Poseidon Principles Secretariat does not formally endorse any service provider.

Signatories are free to work with any third party/service provider of their choice. It is their responsibility to ensure that the provider performs services for them using the latest available Poseidon Principles methodology.

Climate alignment

What is climate alignment?

For the purposes of the Poseidon Principles, climate alignment is defined as the degree to which a vessel, product, or portfolio’s emission intensity is in line with a decarbonisation trajectory. The decarbonisation trajectory is produced by the Secretariat of the Poseidon Principles based on agreed and clearly stated assumptions. Currently, the Poseidon Principles use a trajectory that meets the IMO’s goal of reaching net-zero GHG emissions by or around 2050 compared to 2008 levels.

Historically the Poseidon Principles have been aligned to the IMO’s initial level of ambition, which involved a 50% reduction of CO2 emissions from international shipping compared to 2008 levels. Following MEPC 80 in July 2023, signatories unanimously decided in September 2023 to aligning with IMO’s latest ambition – which aims for net-zero emissions from international shipping “by or around” 2050 compared to 2008 levels, with interim targets in 2030 and 2040, on a well-to-wake basis. Furthermore, the emissions boundary now includes the impact of non-CO2 GHG species namely methane (CH4) and nitrous oxide (N2O).

Alignment means that the shipping portfolio of the signatory is in line with the decarbonisation trajectories over time. Year to year, as well as vessel to vessel or product to product, this may not happen. For entire portfolios, the same idea applies: one misaligned year or two does not mean that it is impossible for the portfolio to align. It may take time to establish a downward trend in line with the trajectory over time. This is especially relevant given the recent increase in ambition reflected in the updated decarbonisation trajectory post IMO MEPC 80 in 2023.

What is greenhouse gas (GHG) intensity? How is it measured?

In shipping, GHG intensity (or emissions intensity) represents the total emissions generated to complete one unit of transport work, which is measured in grams of CO2e per ton-nautical miles. For the Poseidon Principles, this is measured using a carbon equivalent intensity measure known as Annual Efficiency Ratio (AER), which is reported in unit grams of CO2e per dwt-nm (gCO2e/dwt-nm). The IMO DCS enables the calculation of the AER, thus ensuring that the Poseidon Principles are consistent with the IMO’s regulations.

How is the required emissions intensity value for each year up to 2050 calculated?

The target emission intensity in a given year is calculated as a function of the ship type and size as explained in the Technical Guidance. The carbon intensities of individual ship types and sizes are estimated based on the mean AER values from the Fourth IMO GHG Study.

The Poseidon Principles uses continuous required emission intensity baselines for each vessel type and size. The required emission intensity is expressed as follows:

rs=(a.Year3+ b.Year2 +c.Year+d).Sizee

Where rs is the required emissions intensity, Year is the year for which the emissions intensity is required and Size is the size of the vessel in question in deadweight tonnage (DWT), gross tonnage (GT), twenty-foot equivalent unit (TEU) or gas capacity (CBM). The coefficients a, b, c, d and e arising from the fitted curves can be found in Table 6 and Table 7 and the attached technical note with further details.

What are decarbonisation trajectories?

In the context of the Poseidon Principles, a decarbonisation trajectory is a representation of how many grams of CO2e a single ship can emit to move one tonne of goods one nautical mile (gCO2e /tnm) over a given time to be in line with the 2023 IMO GHG Strategy ambition of reducing total annual well-to- wake GHG emissions to net-zero around 2050. This also takes into account the interim checkpoints in 2030 (20% reduction, striving for 30% on 2008 levels) and 2040 (70% reduction, striving for 80% on 2008 levels).

The decarbonisation trajectory represents the emission intensity reduction required to meet certain decarbonisation ambitions. For the purposes of the Poseidon Principles, and consistent with the current interpretation of the 2023 IMO GHG Strategy, the decarbonisation trajectories used were updated to consider:

- The “minimum” interim targets of 20% GHG reduction in 2030 and 70% GHG reduction in 2040 relative to 2008.

- The “striving for” interim targets of 30% GHG reduction in 2030 and 80% GHG reduction in 2040 relative to 2008.

- A net-zero GHG target in 2050

A well-to-wake carbon dioxide equivalent (CO2e) perspective.

The overall decarbonisation trajectory is applied to each vessel category’s baseline value at 2012 providing specific values for each ship type and size because carbon intensities vary as a function of ship type and size, as well as a ship’s technical and operational specification. The trajectory is used to help measure the alignment of vessels, products, and the portfolio of signatories.

The trajectories will be reviewed and improved over time to maintain the robust nature of the initiative and remain in step with up to date climate science and goals.

Who produces the decarbonisation trajectory?

The Secretariat and official Advisory of the Poseidon Principles Association will produce and provide standard decarbonisation trajectory for each ship type-class and size for signatories, based on agreed and clearly stated assumptions. The trajectory is based on the most up to date data source of the IMO recognised information and will be updated once new information becomes available.

It is produced in a format that allows for simple weighting aggregation. This is to ensure that once the emissions intensity of vessels is understood, it is simple and practical to understand climate alignment. This also ensures that numbers are comparable between signatories.

Does the decarbonisation trajectory align with the Paris Agreement?

In September 2022, signatories committed to aligning the Poseidon Principles to the ambition of the Paris Agreement. While the IMO’s revised strategy was more ambitious than expected, there are shortcomings in terms of alignment with the Paris Agreement and reaching a 1.5ºC temperature goal.

However, upon analysis of the impact of MEPC 80, the GHG reduction levels used to define the new Poseidon Principles trajectories are quite close to the 1.5ºC pathway for shipping (Figure 4). Because of this similarity, the Poseidon Principles decided to concentrate on incorporating the forward-looking IMO revised strategy and postponed introducing an additional trajectory aligned with a 1.5°C future for this reporting cycle.

While this means that the trajectories used to measure climate alignment in this report are not aligned with a 1.5ºC temperature goal, incorporating trajectories which represent the 2023 IMO GHG Strategy is still a significant step toward aligning with the Paris Agreement.

How can a portfolio improve its performance?

The Poseidon Principles establish a framework for the assessment of climate alignment and disclosure of ship finance portfolios. It does not provide solutions for how to achieve climate alignment. It is the responsibility of signatories to determine how they choose to improve their portfolio performance.

Broadly speaking, however, to improve a portfolio’s score, it is necessary to reduce the carbon intensity of the vessels that underlie the portfolio relative to their respective decarbonisation trajectory. In the short- to medium-term (1-5 years), for most sectors, especially for ships which travel on long haul routes, the most commercially viable solutions for reducing carbon intensity are through speed reduction and energy efficient technologies and operation scheme. Over the long-term (in 10+ years), the sector will need to use increasing quantities of energy and fuel which produce lower GHG emissions when used on board. Options include harvesting of renewable energy on board (wind propulsion, solar, wave), bioenergy, battery energy storage, synthetic or e-fuels (sometimes also called power-to-liquid or power-to-gas), made from renewable electricity or fossil fuel sources in combination with carbon capture and storage (CCS).

These options are at varying levels of readiness and use. For example, solar has been in use for supplementing auxiliary power for some time. Wind assistance technologies have been in use for some time on several sea going ships, as has battery energy storage and biofuel. Some of these options have yet to be deployed for deep sea shipping operation (for example bioenergy and synthetic/e-fuels) but are already deployed and in operation for short sea shipping. Their application for deep sea shipping use is the subject of intense R&D effort, and their potential availability is expected over the coming decade.

Signatories can engage with clients to identify ways to bring down emissions intensity or they could rebalance their shipping portfolio over time towards parts of the sector that are more climate-aligned or towards technologies that are climate-aligned (e.g., lower-carbon fuels).

Is there an impact of carbon offsetting on the climate alignment?

Being a signatory to the Poseidon Principles does not preclude the use of carbon offsetting, but these are not considered when reporting emissions and assessing climate alignment under the methodology: the full extent of emissions is captured in the assessment of climate alignment.

What is the impact of the fuel type used?

Different fuels emit different amounts of different GHG’s according to their chemical composition. This combines with the efficiency of the vessel’s operation to determine the carbon intensity of voyages. The carbon emission factors to be used can be found in the Technical Guidance. It should be noted that low sulphur variants carry the same carbon emission factor as high sulphur equivalents.

The current regime for GHG accountability is increasingly includes a lifecycle approach to assess the emissions associated with specific fuels. This implies that upstream emissions (emissions from the extraction, cultivation, processing and transportation of fuels before reaching a vessel’s bunker) will play an increasingly important role in decision-making around long lifetime assets such as ships which require an energy source to operate.

The most pertinent to determine upstream emissions for the purposes of the maritime industry is the lifecycle assessment (LCA) guidance, that is due to be finalised in 2024. These LCA guidelines will provide a widely accepted framework for defining emission factors which are expected to become the standard for the industry.

As the Poseidon Principles waits for the distribution of these guidelines, a set of interim emission factors has been developed in the meantime by the Technical Advisory to be able to fully align with the ambition in the 2023 IMO GHG Strategy in the interim period. Main sources used were the provisional IMO LCA Guidelines, material from the European Commission outlining reporting under Fit for 55 regulation, the Fuel EU/ecoinvent database, as well as the GREET framework used in the US. Emission factors for conventional liquid fuels are also available in MEPC 80/7/4.

What about changes in ship design, specificities, efficiency, impact of retrofit works?

Any improvements undertaken by the owner in terms of efficiency (design or operational) will be reflected in the fuel consumption and hence in the data/score.

What is the impact of the (slow) speed strategy/performance of vessels?

Much like other operational efficiency measures, this will result in reduced fuel consumption and hence be reflected in the data/score of the vessel.

Is there an impact of the age of the vessel?

Older vessels may have a higher fuel consumption, which in turn would be reflected in the vessel’s AER.

Calculations & data sourcing

What is the exact data needed in the calculations?

The AER requires the following data to be calculated:

- fuel consumption by fuel type in metric tonnes,

- distance travelled in nautical miles,

- DWT at summer draught.

This data is identical with what shipowners submit to the IMO DCS which means that there is no extra burden on the clients in matter of acquiring the data.

Does the methodology consider lifecycle emissions?

The initial IMO GHG Strategy considered operational emissions (tank-to-wake approach) while the 2023 IMO GHG Strategy captures lifecycle emissions (well-to-wake approach). To comprehensively measure a ship’s total emissions, upstream and operational emissions should be combined, which prevents issues arising from emissions “leakage” due to fuels which have zero carbon emissions on a tank-to-wake basis but higher emissions when their upstream emissions are counted.

To allocate upstream well-to-tank emission factors, assumptions regarding vessel technologies, fuel feedstocks and production processes must be made as currently no set of widely accepted emission factors are in place for non-conventional fuel. This is less of a problem for conventional maritime fossil fuels.

The most pertinent for the purposes of the maritime industry is the lifecycle assessment (LCA) guidance that is due to be finalised and published in 2024. These LCA guidelines will provide a widely accepted framework for defining emission factors which will become the standard for the industry.

As the Poseidon Principles waits for the finalisation of these guidelines, a set of interim emission factors has been developed by the Technical Advisory to be able to fully align with the ambition in the 2023 IMO GHG Strategy. Main sources used were the provisional IMO LCA Guidelines, material from the European Commission outlining reporting under Fit for 55 regulation, the Fuel EU/ecoinvent database, as well as the GREET framework used in the US. Emission factors for conventional liquid fuels are also available in MEPC 80/7/4.

With this information at hand and keeping the logic that transparency will be key to ensure legitimacy and credibility for any pragmatic way forward, the following cascading order of emission factor priority has been adopted:

- Emission factors for conventional liquid fuels available in MEPC 80/7/4 should be used;

- All other emission factors should be taken from the Fuel EU/ecoinvent database.

- Any other emission factors should be taken from the GREET database.

A complete list of emission factors can be found in the Technical Guidance.

What is the source of the well-to-wake conversion factors?

Interim emission factors have been developed by the Poseidon Principle’s Advisory to be able to fully align with the ambition in the 2023 IMO GHG Strategy in the interim period before the publication by the IMO of updated lifecycle assessment (LCA) guidance.

The following cascading order of emission factor priority has been adopted:

- Emission factors for conventional liquid fuels available in MEPC 80/7/4 should be used;

- All other emission factors should be taken from the Fuel EU/ecoinvent database.

- Any other emission factors should be taken from the GREET database.

Is it common to other methodologies?

It is the same as used in other IMO regulatory mechanisms (e.g., EEDI).

To which extent is the data adjusted to “real” performance?

The source of the data is from direct operations from the ship using the methodology provided by the IMO DCS. Therefore, the data is not adjusted, rather it is as provided by vessel for mandatory purposes.

Will the process for collecting data be applied on time by the various parties?

The IMO DCS is mandatory and has gone into effect in January 2019. Shipowners who do not comply within the timeframe set by the IMO will not have a Statement of Compliance which will affect their license to operate. In other words, it is not availability of data but rather access to the data for these purposes that will be of primary concern for signatories. It is the assessment of the law firm WFW that lenders are within their rights under existing loan agreements to demand disclosure of data necessary to comply with the Poseidon Principles.

Nonetheless, the Poseidon Principles do take into account that in some circumstances, collecting the necessary data may not be possible. In this instance, Signatories will be required to disclose the percentage of the eligible loan book for which there is non-disclosure. This information has been publicly disclosed since 2022.

If signatories decide to do the calculations themselves (allowed pathway), will an accountability assessment be made?

An external audit is not a requirement of the Poseidon Principles. However, in practice, some banks will choose to have an independent assessment in line with their other reporting activities.

Signatories to the Poseidon Principles are expected to comply with both the Accountability and Transparency requirements. Altogether, these are:

a. The overall climate alignment of the signatory’s shipping portfolio reported as a +/- percentage figure; since 2022, signatories can also choose to disclose climate alignment scores split by cargo or passenger vessels

b. The percentage of eligible shipping portfolio that is reported;

c. The percentage of portfolio for which preferred and allowed pathway tracks were used;

d. A list of the providers it used.

All information will be shared privately with other signatories. Thus, if a signatory make all calculations on their own, they will have to report that to the Secretariat, which will share this information with other signatories. Only the portfolio alignment scores and the reporting percentage will be made public.

What are the consequences if signatories can’t obtain approval from all borrowers under (existing) loan agreements to collect the relevant data for the calculations?

It is the opinion of WFW that typically lenders will be well within their rights to ask their clients for this information. However, it is recognised that collecting 100% of relevant data may not be possible in some circumstances.

In this instance, signatories will be required to disclose the percentage of their eligible loan book for which they have non-disclosure. This information will be available to other signatories and has been public since 2022. Please see Table 3 in the technical guidance of the Poseidon Principles for an example of this.

Is there a minimum threshold of data collection under which the calculations would be considered as non-relevant?

No, there is no minimum threshold but signatories are required to disclose the percentage of their eligible loan book for which they have non-disclosure. This percentage is calculated against % of signatory’s debt in portfolio and gets published in the Annual Disclosure Report alongside signatory’s climate alignment score.

Would it be possible to run a test on a theoretical portfolio?

Several signatories ran a pilot. If you wish to run a test, please contact the Secretariat for further information.

Classification societies

How are organisations qualified as Recognized Organizations?

A Recognized Organization is an authorised organisation that performs statutory requirements on behalf of a vessel’s flag state. While typically a Classification Society, in the case of the IMO DCS, independent verifiers have been authorised by some flag states. This specific list of RO’s may differ from flag state to flag state.

The Secretariat will not approve the ROs but operate on a basis of trust that ROs authorised by the IMO DCS will be acceptable to perform services required to comply with the Poseidon Principles.

Is it possible to source all the data needed to report on an entire portfolio from a single classification society, even though all vessels financed by the signatory are not classed by the same classification society?

Classification societies are members of the International Association of Classification Societies (IACS) and as such can work together to share the data (and have done so in other contexts).

Enforcement of the Principles

What does enforcement look like?

The enforcement process is outlined in the Technical Guidance and is the primary guide to meeting the requirements of the Poseidon Principles. The Secretariat, in conjunction with the Steering Committee, will, as outlined in the Governance Rules, update the Technical Guidance to ensure the Poseidon Principles are up to date.

What is the standard covenant clause

Lenders are within their rights under most current loan covenants to demand disclosure of data necessary to comply with the initial Poseidon Principles. It was at the request of shipowners in the drafting group that the Poseidon Principles should include a standardised covenant clause covering the more specific information so that they do not have to negotiate similar wording with every lender.

While the covenant wording is strongly recommended, it is not compulsory for signatories. However, if all signatories start using it in new loan agreements it will de facto be in common usage. There is no suggestion that existing loan agreements should be amended.

The standard covenant clause is available on the Resources page.

Reporting & transparency

What is the process for calculating and reporting portfolio alignment?

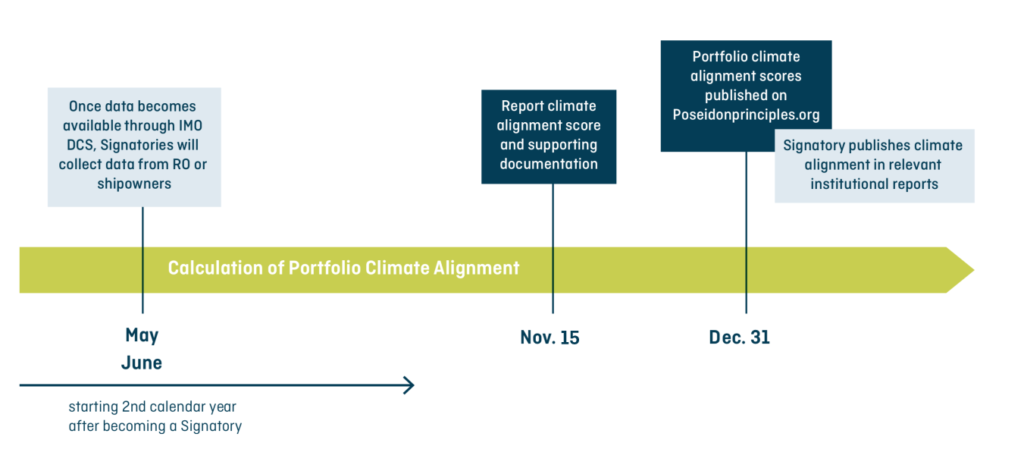

Signatories will annually assess climate alignment in line with the Technical Guidance for all business activities. This means that signatories will calculate the emission intensity of vessels in their portfolio in order to assess the climate alignment at the portfolio level, using data collected in the IMO DCS, decarbonisation trajectories produced by the Secretariat and financial institutions’ loan book data.

The timetable for implementation below highlights when there are important deadlines for alignment and reporting:

What exactly do signatories need to report? What of that becomes public?

As a signatory of the Poseidon Principles, the reporting requirements are:

The overall climate alignment score of a signatory’s shipping portfolio reported as a +/- percentage figure. Since 2022, signatories can also choose to disclose climate alignment scores split by cargo or passenger vessels.

- The percentage of eligible shipping portfolio that is

- The percentageof portfolio for which preferred and allowed pathway tracks were

- A listof the names of providers it used.

Only the signatory’s climate alignment score(s) and their reporting percentage will be published. All other information listed above will be shared with other signatories but will not be made public. For further details see the Transparency section of the Technical Guidance or the Signatory Reporting Template on the website.

Does becoming a signatory create significant reporting requirements?

Every effort has been made to minimize the reporting requirements of the Poseidon Principles themselves. While it is required that signatories include their portfolio climate alignment figure(s) in relevant institutional reports (e.g., sustainability reports), the Poseidon Principles do not interact with any other reporting initiatives.

How will the portfolio climate alignment score be published?

The Poseidon Principles Association publishes the portfolio climate alignment scores of signatories on its website in a report which provides some context in order to put the climate alignment scores in perspective and correctly interpret them. The previous reports can be found on the Resources page.

Signatories are required to publish their portfolio climate alignment scores in relevant institutional reports (e.g., sustainability report) on a timeline that is appropriate for them. There is, however, nothing to stop individual signatories to publish their climate alignment at a more granular level, for example by vessels categories.

Governance

How are the Poseidon Principles Association governed?

The Poseidon Principles Association manages, administers, and develops the Poseidon Principles. The members of the Poseidon Principles Association are the signatories to the Poseidon Principles.

What are the roles within the Poseidon Principles Association Association?

Steering Committee

The Steering Committee is comprised of 8 to 15 representatives of signatories to the Poseidon Principles. One member acts as Chair, one member as Vice Chair, one member as Treasurer. Steering Committee members hold a senior position in their companies relevant for the Poseidon Principles. The Steering Committee leads the Association’s meetings. Members of the Steering Committee are volunteers and are therefore not compensated by the Association. The list of members currently part of the Steering Committee can be found on the website.

Signatories

All signatories are members of the Poseidon Principles Association and are encouraged to participate in and contribute to the management of the association in a manner that supports the Principles and is appropriate for their institution. Those institutions who have become signatories will appoint a senior representative to join relevant meetings of the association, such as the Annual Meeting. Just as with the Steering Committee, the representative must hold a position relevant to the Poseidon Principles. Signatories can nominate a representative from their institution to become a member of the Steering Committee. Nominees are then voted into positions by all signatories and serve a term in the Steering Committee as outlined in the Governance Rules.

Technical Committee

Signatories previously agreed to establish the Technical Committee. Its role is to ensure methodological integrity of the Poseidon Principles within the scope agreed by the Steering Committee. The Technical Committee does not have decision-making power; it formulates proposals which are then brought up to signatories. The Technical Committee is composed of a subset of signatories and is supported by the Advisory and Secretariat. Technical Committee members must hold appropriate technical background.

What are the support roles within the Association?

Secretariat

The role of the Secretariat is to maintain the day-to-day business and administration of the Steering Committee, the Principles, and the signatories. The Secretariat serves a facilitating function in the Steering Committee, Technical Committee, and among signatories. The Secretariat role can be fulfilled by a relevant non-profit and independent third-party entity. This role is currently fulfilled by the Global Maritime Forum.

Advisory

The advisory advises and guides the technical discussions and expertise of the Principles, including creating and revising the scope of the Principles or the decarbonisation trajectory. It ensures the used methodology and data found in the Principles are current, relevant, and simple to implement for signatories. The advisory is also involved in working groups and takes part in the Steering Committee or Technical Committee meetings as needed. Current technical advisories are UMAS and Rocky Mountain Institute.

POSEIDON PRINCIPLES

Get in touch

Where to find us

Amaliegade 33 B, 3rd floor

1256 Copenhagen K

Denmark

VAT Number: 40632379